Unlock the Cash Potential of a Life Insurance Policy with a Tax Favorable Life Settlement

Policy Appraisers offers Lump Sum Cash Settlements on Permanent or Term Life Insurance Policies. In many cases, the cash proceeds paid to the policy owner have favorable tax benefits. Our team has 100+ years of combined experience and have facilitated over $10 Billion in Life Settlements.

Unlock the Cash Potential of a Life Insurance Policy with a Life Settlement

Policy Appraisers offers Lump Sum Cash Settlements on Permanent or Term Life Insurance Policies. Our team has 100+ years of combined experience and have facilitated over $10 Billion in Life Settlements.

Click Play on the Image Below to Learn More:

Click Play to Learn More:

Policy Lapse Results in Billions of Dollars in Lost Life Insurance Benefits Every Year

Billions of dollars in potential Tax Favorable Life Insurance Settlements go unclaimed each year in the United States due to policy lapse. Industry experts say that 90% of Life Insurance Policies do not pay a death benefit claim. Life Insurance companies are the biggest beneficiaries of policy lapses and typically do not educate policy owners on alternatives to policy cancellation and lapse. A Life Settlement offers the option of selling a life policy in the secondary market as opposed to making the mistake of "throwing away" a potential asset with cash value.

Expand Your Practice by Offering Tax Favorable Life Settlements

Planning Professionals can offer clients the option to generate liquidity from a Life Settlement for all or part of a Term or Permanent life insurance policy. Life Settlements can be Tax Favorable and Offer up to 5 times the cash value. Policy owners receive a lump sum Cash Settlement based on a percentage of the death benefit and other factors such as age and health underwriting. Policy proceeds have tax advantages and can become an investable asset.

Turn Key Case Support

Policy Appraisers navigates the intricate world of life settlement underwriting with a high touch Concierge philosophy. Our experienced Life Settlement team offers "turn key" case support that ensures optimal outcomes for the Policy Owner. The Life Settlement process typically takes about 6 to 8 weeks to process and fund.

Consider Policy Appraisers your Life Settlement Partner

Policy Appraisers offers guidance on the long term impact of keeping a Life Insurance policy active or pursuing the benefits of a Life Settlement with favorable Tax Treatment. Key Person Life Policies are typically expensive and unnecessary when a business is sold or when the insured has retired. If a policy is donated, a Charitable Trust will pay the premiums due to keep a policy in force but quite often, the donor will live longer than expected causing the policy to become "upside down" by turning the policy into a negative asset for the trust.

Unlock the Potential of Tax Favorable Life Settlements

Life Insurance premiums for many Seniors on a fixed income can become unaffordable. A Life Settlement offers the policy owner the opportunity to convert the expense of policy premiums into a tax favorable lump sum. Settlement proceeds can be used for any reason such as, investment, long term care annuities, medical expenses, paying down debt, final expenses, education of a grandchild, or charitable giving.

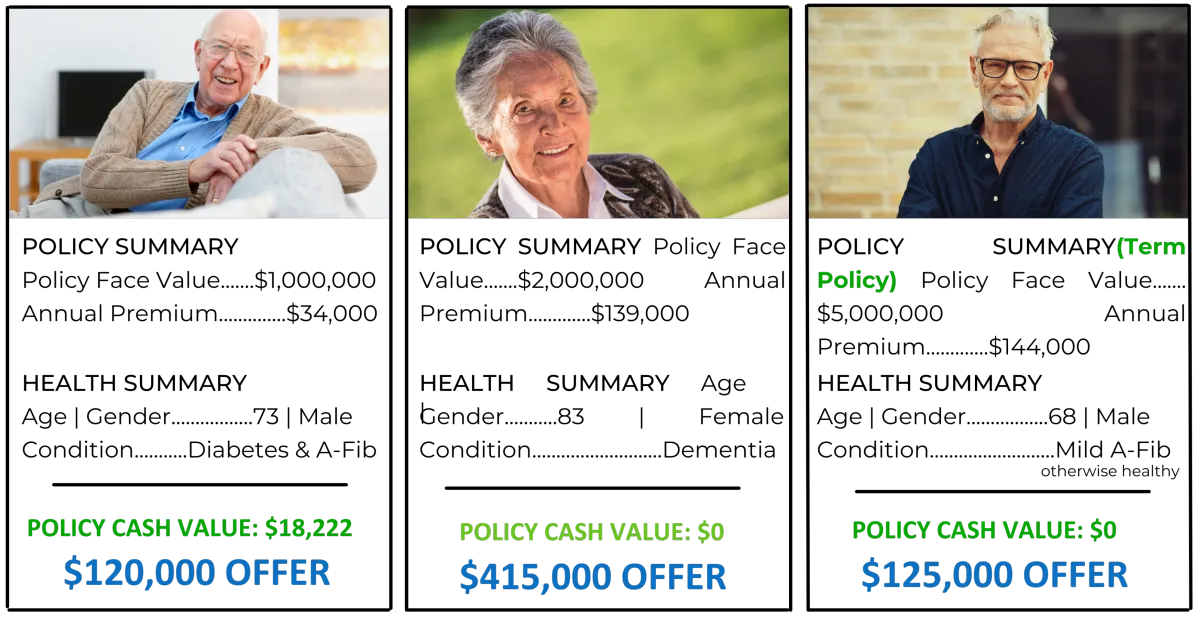

Actual Life Settlement Case Examples

FAQs

Your Questions Answered: Understanding Life Settlements

What is a Life Settlement?

A Life Settlement occurs when the owner of a Life Insurance Policy assigns or transfers the ownership of the policy to a Buyer or Third Party in exchange for a cash payment. Our Policy Appraiser team works with secondary market investors that have facilitated billions of dollars of Life Settlements.

How do I know if my policy qualifies for a Life Settlement?

A permanent or term Life Insurance policy must be in force to qualify. If a policy is subject to a 'lapse period" then an owner may have the option to reinstate the policy. Our Policy Appraiser team can guide you on any additional underwriting factors that will help you to derive the maximum settlement amount.

Is a Life Settlement Considered to be Tax Favorable?

Great question! In most cases, the tax treatment of a Life Settlement has minimal impact to the owner. The settlement amount is taxed in various steps or tiers. The amount of the settlement that is attributed to the original premium paid in is usually considered "tax free". You should always seek advice from a qualified tax specialist prior to a life settlement.

Does my Life Policy have more or less value with Age?

Yes, the age of the policy owner is one of the primary determining factors in the final settlement amount. The good news is that in most cases, settlement amounts are increased if a client is older or has less life expectancy. This underwriting factor is also expanded if the client is considered chronically ill or terminal.

May I use the Cash from a Life Settlement for any purpose?

Another great question! Yes, the Cash Proceeds from a Life Settlement may be used for any purpose. Our Policy Appraiser Planning Team can provide further guidance on how to best invest the proceeds for your future health and well being.

How long does the Life Settlement process take?

The first step requires about a week to determine the estimated value or appraisal of the Life Insurance Policy. Your Policy Appraiser team will then focus on the underwriting and bidding process. Once an offer is accepted it takes about one to two weeks to close and fund the Life Settlement. Proceeds are typically paid directly to the owner's bank account or via check.

Are there any risks involved in Life Settlements?

While a life settlement can offer immediate financial benefits, there are considerations such as losing the death benefit and potential tax implications. Policy Appraisers can help to define the potential risk and benefits of pursuing a Life Settlement.

How is the value of my policy determined?

The value is influenced by factors such as, death benefit, health, premium costs, and life expectancy. The final settlement value is the result of what an investor is willing to pay the owner. Policy Appraisers will receive a fee when the life settlement offer is finalized and the policy owner receives payment. A few Life Settlement cases are illustrated in the section above the FAQ area.

Is it True that a Majority of Life Insurance Policies Lapse?

Some industry estimates are that 99% of Term Life Policies lapse. Typically a permanent policy can be surrendered for the Cash Value. In many cases, owners of a Permanent or Term Life Policy pursuing a Life Settlement receive substantially higher lump sum payouts, but many are unaware of the settlement option. Don't surrender or allow your policy to lapse until you have an opportunity to consult with Policy Appraisers.

I am a Planning Professional seeking resources to help determine if a Life Settlement is suitable for my client

Policy Appraisers works directly with Certified Financial Planners, Certified Public Accountants, Life Insurance agents and Financial Advisors. Our team also offers case support and resources to Elder and Estate Law attorneys. Planning professionals may contact David Yates directly at 214.649.6457 for more information.